From If-Then to Intelligent: Comply AI and the Agentic Architecture Behind Ahrvo Network

🎧 Don’t forget! Our podcast discussing these topics is available on Spotify and Apple Music.

This week, we're exploring how Ahrvo Network harnesses artificial intelligence to transform financial operations. Today, we're spotlighting Ahrvo Labs' agent platform, Comply AI.

The financial compliance world is broken.

We see it every day—organizations trapped between rigid regulations and fragmented technology, where every step forward seems to require two steps backward.

In conversation after conversation with compliance teams, a pattern emerged: systems that don’t talk to each other, data locked in silos, and highly skilled professionals spending considerable time on manual, repetitive tasks—rather than focusing on actual risk. This is inefficient and a misalignment of human capital.

That’s why we built Comply AI differently.

We didn’t start with a technology stack. We started with a question: How do we augment human judgment, connect fragmented systems, and adapt to ever-changing regulations—without constant reprogramming?

The answer wasn’t another point solution or rules engine.

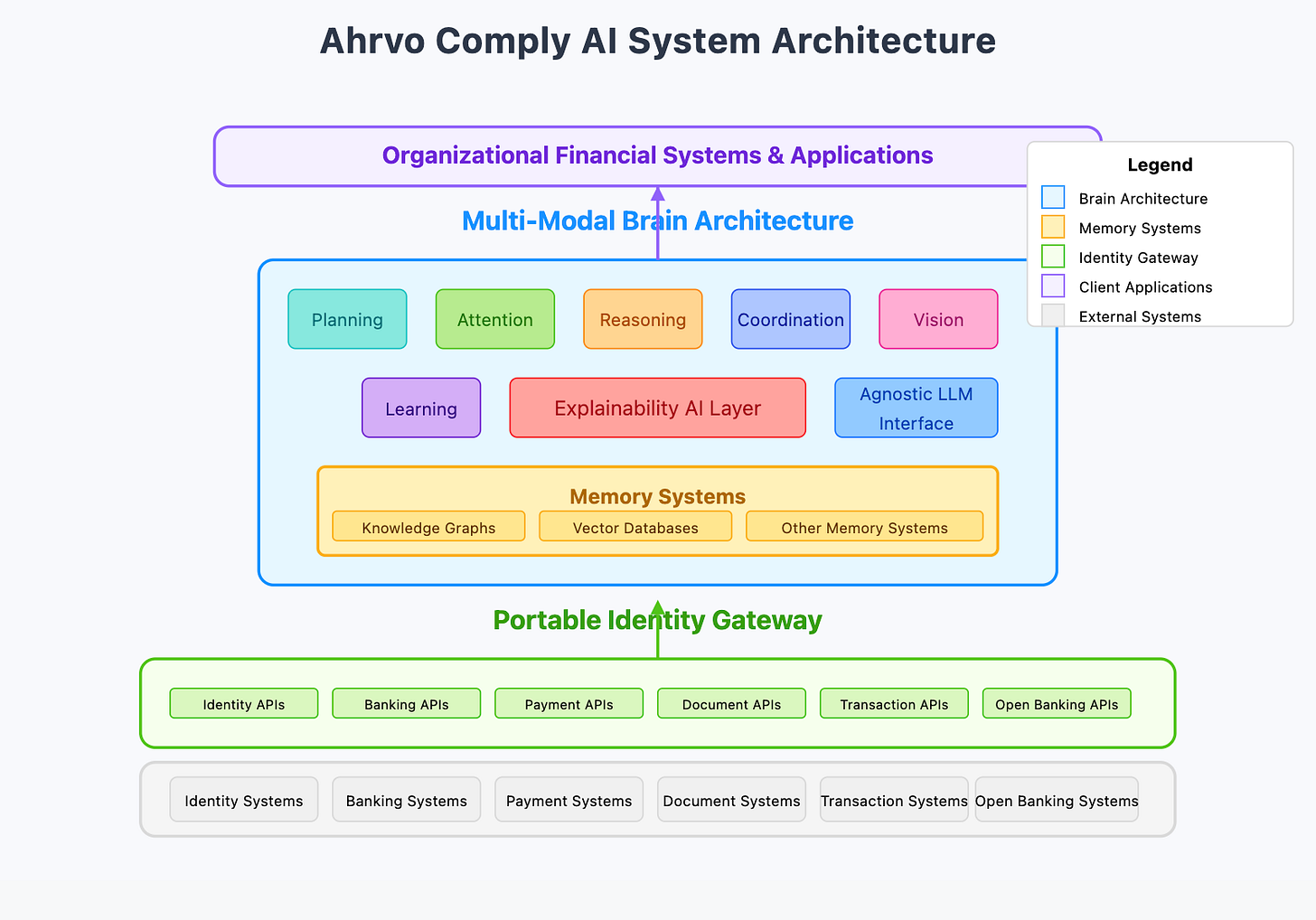

Instead, we designed a multi-modal brain architecture that mirrors how compliance and risk professionals think: planning ahead, focusing attention where it matters, reasoning through complexity, coordinating across systems, and learning from outcomes. We made Comply AI vendor-agnostic because real-world financial infrastructure is messy and mixed. Transparency is built into its core—because black-box AI has no place in regulated industries.

Comply AI isn’t simply about automating automation. It’s about adaptation.

It empowers compliance professionals to become strategic operators, not bottlenecks. It sees connections that humans simply can’t at scale. It builds a financial infrastructure that’s secure, intelligent, and adaptive.

This is the future of financial compliance— Not just checking boxes but understanding context, connections, and consequences.

The Cognitive Foundation: Beyond Traditional AI

Comply AI's multi-modal brain architecture integrates several advanced cognitive capabilities that work in concert:

Planning

The planning module enables Comply AI to develop structured approaches to complex compliance challenges. Rather than simply responding to immediate triggers, our system can map out multi-step processes, anticipate potential compliance issues, and develop proactive strategies. This means the system can determine, for instance, the optimal sequence for onboarding a new type of client while ensuring all KYC/B (Know Your Customer/Business) requirements are met efficiently.

Example: When processing a high-value international transaction for a new beneficiary, Comply AI automatically develops a multi-step verification plan that includes appropriate KYC checks, sanctions screening, beneficial ownership verification, and transaction risk assessment—all sequenced optimally for both security and speed.

Attention

In the universe of financial data, knowing what matters is as crucial as processing the data itself. Comply AI's attention mechanisms allow it to focus computational resources on the most relevant aspects of any given situation. When reviewing transaction patterns, for example, the system can rapidly identify anomalies that might indicate compliance risks while filtering out routine variations that pose no concern.

Example: While monitoring a corporate account's transaction patterns, Comply AI notices subtle changes in payment frequencies that, while individually minor, collectively suggest potential early warning signs of account takeover when analyzed in context.

Reasoning

Beyond simple pattern recognition, Comply AI employs sophisticated reasoning capabilities to understand the "why" behind data patterns. This includes deductive reasoning (applying general rules to specific cases), inductive reasoning (deriving general principles from specific observations), and abductive reasoning (forming likely explanations from incomplete information). This multi-faceted approach enables nuanced judgments about complex financial activities.

Example: When reviewing documentation for a complex corporate structure, Comply AI can identify indirect control relationships that might indicate regulatory concerns, even when these relationships span multiple jurisdictions and involve diverse ownership structures.

Coordination

Modern financial ecosystems involve numerous stakeholders, systems, and processes. Comply AI's coordination layer orchestrates interactions between different components of the compliance workflow, ensuring that information flows smoothly between systems and that handoffs between process stages occur without friction. This prevents the "silo effect" that plagues many compliance operations.

Example: During client onboarding, Comply AI orchestrates document collection, verification, risk rating, and approval workflows across multiple vendors and systems, ensuring all steps occur in the optimal sequence with appropriate handoffs, audit trails, and data reconcilation.

Vision

Comply AI's vision capabilities allow it to process and extract meaning from visual documents such as identification cards, contracts, statements, and other financial instruments. The system can recognize document types, extract relevant data fields, verify authenticity markers, and even detect visual inconsistencies that might indicate fraudulent documents.

Example: When reviewing a new customer’s ID, Comply AI verifies document authenticity, extracts key data fields, matches the photo to a live selfie and biometric sources, and checks for inconsistencies across metadata and past onboarding attempts. If issues arise, it can either prompt the user for clarification or escalate to a human reviewer with full context and audit history.

Learning

While traditional compliance systems follow static or even “dynamic” rules, Comply AI continuously improves through exposure to new data patterns and outcomes. This learning capability means the system becomes increasingly effective at identifying emerging compliance risks, handling scenarios, and adapting to regulatory changes without extensive reprogramming.

Example: When detecting an unusual spike in cross-border payments from a low-risk merchant, Comply AI correlates the activity with similar emerging patterns across its knowledge graph. Recognizing the behavior as consistent with a known layering technique in money laundering, it adapts by tightening transaction thresholds, flagging the activity, and updating risk scores in real time—without manual intervention.

The Transparency Advantage: Explainability AI Layer

One of the significant challenges with AI in financial compliance is the "black box" problem—when decisions are made without clear explanations of the reasoning behind them. This lack of transparency can create regulatory issues and undermine user trust. Ahrvo Comply AI addresses this challenge head-on with our Explainability AI Layer.

The Explainability AI Layer transforms complex decision processes into clear, understandable explanations tailored to different stakeholders:

Regulatory Transparency

For compliance officers and regulators, our system provides detailed audit trails that reason factors influenced each decision, the weighting of different variables, and the specific rules or patterns that triggered actions. This level of transparency enables easier regulatory reviews and demonstrates due diligence in compliance processes.

Operational Clarity

For operational staff, the system provides practical explanations that focus on actionable insights—what needs attention, why it matters, and what steps should be taken next. This operational clarity helps staff understand AI-guided recommendations and make informed decisions quickly.

Executive Insights

For leadership teams, the Explainability Layer synthesizes complex compliance, payment, and banking activity into strategic insights, providing clear visibility into risk patterns, operational bottlenecks, and emerging compliance trends across the organization.

Technical Implementation

Our Explainability Layer works by:

Tracking decision factors and their influence on outcomes

Translating complex patterns into natural language explanations

Generating visual representations of decision processes

Creating confidence scores for different decision paths

Producing documentation that meets regulatory requirements

Leverages a learning layer to take into account feedback and adjust accordingly

By making AI reasoning clear and accessible, we empower humans to collaborate effectively with automated systems, combining the processing power of AI with the contextual understanding and judgment of experienced professionals.

Why This Architecture Matters

Effective compliance management demands a memory architecture designed for context—one that preserves information across interactions, time, and systems. Comply AI leverages multiple layers of memory, with knowledge graphs and vector databases forming two components of this contextual intelligence.

Knowledge Graphs

Knowledge graphs are structured semantic networks that represent entities (like customers, accounts, transactions) and the relationships between them. This approach allows Comply AI to understand complex networks of financial relationships that might indicate beneficial ownership structures, related party transactions, or other compliance-relevant patterns. By representing information as interconnected nodes rather than isolated data points, knowledge graphs enable more sophisticated analysis of financial relationships.

Our implementation of knowledge graphs enables:

Relationship mapping between customers, accounts, transactions, and workflows

Visual representation of complex ownership structures for intuitive understanding

Detection of hidden connections between seemingly unrelated entities across multiple systems

Efficient navigation of regulatory requirements across different jurisdictions

Persistent structural memory that maintains relationship history over time

Dynamic update of relationship structures as new information emerges

Cross-referencing of entity relationships with regulatory watch lists and risk databases

Automated flagging of structural patterns associated with elevated compliance risk

Vector Databases

Vector databases store and retrieve information based on semantic similarity rather than exact matching. This capability allows Comply AI to identify conceptually related compliance issues even when they manifest in different ways. For example, if the system encounters a new type of potential money laundering technique, it can recognize similarities to known patterns even without an exact match to previously identified cases.

Our vector database capabilities include:

Similarity-based matching of transaction patterns to known risk scenarios

Contextual understanding of document content regardless of formatting or language

Efficient storage and retrieval of compliance precedents for consistent decision-making

Cross-lingual recognition of similar patterns in multilingual documents

Semantic search across historical compliance cases and regulatory guidance

Anomaly detection through vector space clustering and distance measurement

Progressive learning from new examples without retraining entire datasets

Fuzzy matching capabilities that recognize document variations despite minor differences

From Fragmentation to Orchestration

Comply AI is engineered to work with any identity, document, or transaction management provider. This level of vendor agnosticism is critical for institutions that already have robust systems in place and want to avoid the high switching costs associated with traditional integrations. Our platform supports over 20 native compliance integrations, and its open architecture is designed to seamlessly connect to new systems as they emerge.

The platform works seamlessly with:

Multiple LLM providers, allowing organizations to leverage the best language models for different compliance tasks

Any knowledge graph implementation, accommodating organizations with existing semantic data structures

Various vector database technologies, ensuring compatibility with different approaches to similarity-based retrieval

Diverse identity, document, and transaction management APIs, eliminating the need to replace existing infrastructure

This flexibility means that implementing Comply AI doesn't require a complete overhaul of existing systems. Instead, our agent platform serves as an intelligent coordination layer that enhances and connects previously isolated systems.

The benefits of this vendor-agnostic approach include:

Reduced Integration Costs: Connect to existing systems without expensive replacement projects

Faster Implementation: Deploy new compliance capabilities in weeks, not months

Risk Reduction: Avoid disruption to critical financial operations

Future-Proofing: Add new providers or capabilities without rebuilding integrations

Operational Flexibility: Select best-of-breed solutions for each specific need

Designed for Modern Infrastructure

The Portable Identity Gateway centralizes access to hundreds of APIs from various vendors into a single, integrated channel. This means that our agents can orchestrate complex workflows without needing separate integrations. The result? A truly modular, scalable system that reduces redundancy, minimizes onboarding delays, and creates an automated workflow and reconciliation process complete with robust audit trails.

Key capabilities include:

Unified Access: With one integration, clients gain access to a vast ecosystem of financial APIs, all while maintaining full control over their data.

Automated Orchestration: Our agents coordinate between different services—ensuring that every transaction, identity check, or compliance query is processed efficiently.

Seamless Interoperability: The Gateway's vendor-agnostic design means it works with any identity, document, or transaction management system, allowing you to retain the tools you trust while adding new layers of automation.

Extensive Workflow Support: The system can handle hundreds of various identity, document, and transaction management workflows, adapting to your specific operational requirements.

The Power of Unified Compliance

By uniting Comply AI with our Portable Identity Gateway, we offer a unified platform that streamlines compliance, payments, and banking and empowers institutions to be vendor-agnostic. Comply AI system works seamlessly with over 20 compliance solutions from Ahrvo Comply, and it can leverage with any identity, document, or transaction management provider.

Meanwhile, our Portable Identity Gateway unlocks access to hundreds of payment and banking APIs through a single integration, allowing our agents to orchestrate complex workflows that previously required a patchwork of disconnected systems.

This powerful combination creates a comprehensive solution that automates end-to-end financial workflows:

Seamless handling of payment processing across multiple providers

Automated banking operations with appropriate compliance checks

Unified identity verification across different systems and requirements

Comprehensive document management with intelligent extraction and verification

Transaction monitoring with contextual understanding of compliance implications

Orchestration of hundreds of identity, document, and transaction management workflows

The result is a system that not only identifies compliance issues but actively manages the entire lifecycle of financial operations with appropriate compliance controls embedded throughout. Our platform serves as the intelligent nervous system connecting previously siloed processes into a coherent, automated whole.

The Operational Advantage

By enabling agents to handle payment, banking, and compliance workflows from any API—including the hundreds Comply AI has access to—organizations gain significant operational advantages:

24/7 Processing: Automated workflows operate continuously without human intervention

Consistent Application of Rules: Uniform handling of compliance requirements across all transactions

Reduced Processing Time: Tasks that took days can now be completed in minutes or seconds

Lower Operational Costs: Dramatic reduction in manual processing requirements

Error Reduction: Elimination of human error in routine compliance tasks

Scalability: Handle volume spikes without staffing challenges

Enhanced Analytics: Comprehensive data collection enables better risk assessment

Key Components of the Ahrvo Ecosystem

Our integrated solution combines three powerful components:

Ahrvo Comply: 20+ identity, document, and transaction management solutions

Comply AI: A cognitive engine that automates compliance, payment, and banking workflows using a proprietary multi-modal brain architecture.

Portable Identity Gateway: A secure, vendor-agnostic gateway that provides access to hundreds of payment and banking APIs through one integration, enabling streamlined orchestration of identity, document, and transaction management systems.

Together, these components create a comprehensive platform that can handle hundreds of diverse workflows while maintaining security, compliance, and operational efficiency.

From Silos to Synthesis

Consider the traditional approach to financial compliance, payment, and banking: disparate systems handling different aspects of the process, manual reconciliation between systems, and limited visibility across operations. This fragmentation creates numerous problems:

Compliance gaps where handoffs between systems occur

Inconsistent application of compliance rules

Difficult-to-trace audit trails

Resource-intensive reconciliation processes

Limited ability to detect complex compliance issues that span multiple systems

Comply AI transforms this fragmented landscape into a cohesive, intelligent ecosystem. By connecting previously isolated systems through intelligent agents, the platform creates:

Continuous compliance monitoring across all financial operations

Automated reconciliation between different systems

Comprehensive audit trails that span the entire process

Intelligent identification of complex compliance patterns

Reduced operational overhead for compliance activities

The regulatory landscape for financial services is constantly changing, with new requirements emerging regularly. Comply AI's adaptable architecture ensures that organizations can respond to these changes without major system overhauls. The platform's learning capabilities mean it can incorporate new compliance patterns, while its vendor-agnostic design allows for integration with new specialized tools as they emerge.

Conclusion: The Art of Automating Automation

Comply AI marks a shift in how organizations approach financial compliance and operations. By streamlining operations, reducing risk, and accelerating decision-making, our platform empowers businesses to operate with greater confidence and agility.

Ahrvo Network bridges the gap between complex financial workflows and evolving regulatory demands. This isn't about meeting today's compliance requirements—it's about building a foundation that adapts to the financial landscape.

For organizations aiming to modernize payments, banking, and compliance processes, Comply AI offers a powerful, non-disruptive solution. It enhances—not replaces—existing systems, delivering intelligence that actively improves operational performance.

By supporting hundreds of workflows without requiring a vendor switch, Comply AI eliminates fragmentation and streamlines complexity. Ahrvo Network is redefining what’s possible in financial operations—delivering smarter compliance, seamless integration, and a new standard of operational efficiency.

👉 Experience the Future of Financial Compliance

See how Ahrvo Network's Comply AI can transform your approach to financial compliance with our interactive demonstration. Our experts will show you how to:

Connect your existing systems without disruption

Automate your most time-consuming compliance workflows

Reduce operational costs while enhancing compliance effectiveness

Book Your Personalized Demo Today

About the Author

Appo Agbamu, CFA, is the Founder and CEO @ Ahrvo Labs Inc. Ahrvo Labs develops, markets, and sells compliance, payment, and banking solutions. Agbamu earned a B.Acc. in Accounting and a BBA in Economics, w/a minor in Financial Markets from the University of Minnesota. In addition, Agbamu is a Chartered Financial Analyst (CFA) charterholder.

About Ahrvo Labs

Ahrvo Network is on a mission to accelerate financial innovation by making it easy for businesses to launch, scale, and monetize compliant financial services. Through a single, unified platform, we connect companies to a global network of 800+ financial institutions — streamlining onboarding, integration, and access. By removing friction and unlocking opportunity, we empower the next generation of financial products to reach global markets with speed, trust, and scale. Learn more @ https://ahrvo.com